Venture Capitalist Firms

Most Read Blog Posts

[ad_1]

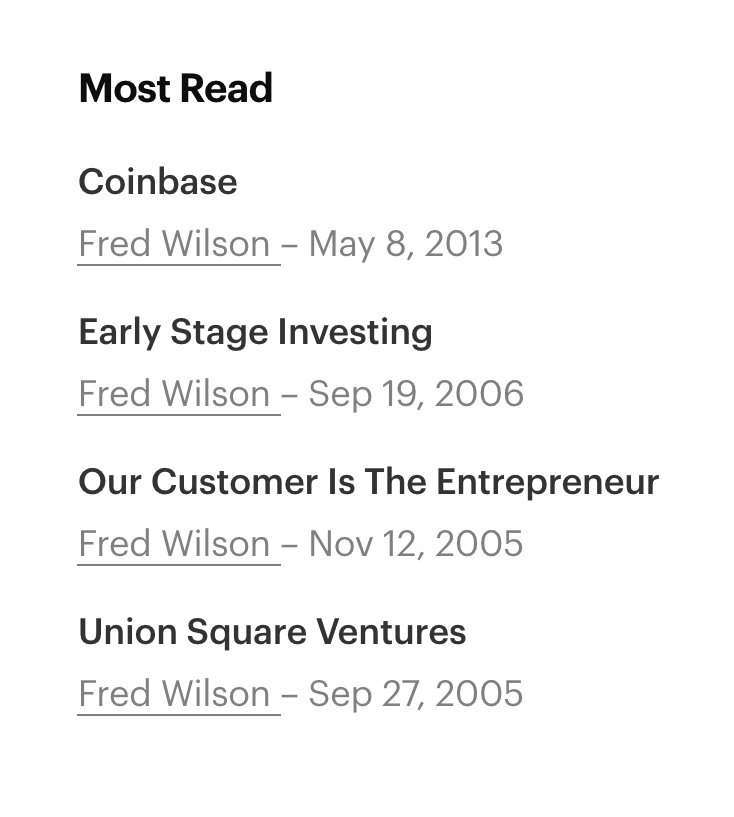

On the USV website, we show the most read blog posts by author.

I want to do this for AVC too. I will ask my partner Nick who managed the construction of USV.com how he did that and will see if I can get that working on AVC.

When you’ve written 8,800 posts, there are sure to be some duds and some great ones. It would be nice to showcase the great ones.

USV TEAM POSTS:

[ad_2]

Source link

Venture Capitalist Firms

LA Living

[ad_1]

We are camped out in LA for two weeks. There are many things I love about LA. The work day ends around 3, the weather is great, the pace of life slows down, and the farmers markets are incredible. We dug in and hit many highlights. Fred was on a golf jaunt, and I showed up last Saturday. First stop, Echigo, for dinner, Bigg Chill for dessert. A move we had perfected over two decades.

On our first afternoon, we drove down to Dover Street for a little shopping and lunch. Cafe 2001, which opened this past February, might have been one of our best meals. It is a brutalist cafe with an atrium in the middle and seating on the second floor, peering downstairs decorated with a mixture of mid-century chairs and tables. The salad of pears, celery, and sunchokes mixed with a country vinegarette was out of this world.

There were other hits; the pork tenderloin katsu sandwich with pickled veggies on the side tasted like Japan.

The star, although the salad comes close, is the lemon tart. It was perfect, with the small dollop of creme fraiche on the side, but the key is the sugar crust, like a creme brulee, took the tart to another level.

We stayed east because the traffic would be unbearable getting back. We went over to Jeffrey Deich and saw Nina Chanel Abney’s work, which reminded me of Derrick Adams’s work.

The next afternoon, we went to the Hammer Museum. The show was of Alice Coltrane’s music, work, and story.

We had dinner in Beverly Hills at Jars, where you can always get a solid meal. We strolled around before on Rodeo Drive. Rodeo Drive was peaking when I interned in LA during the first semester of my senior year of college. The luxury stores are empty of customers, and the assortments are terrible. Sad actually. I saw this sign in one of the alleyways that defines the area.

The purple house is classic. When we lived in Michigan, my father told me he was going to paint the house purple, which I thought was amazing, but of course, that never happened.

The other highlights were having a martini at the Bel Air Hotel, which has such beautiful grounds, and going to Izakaya Hero for dinner. The deboned wings are stuffed with pork.

The fried oysters.

And the warm tofu with fish roe was outstanding.

The next day, we went classic for lunch. Pro tip: the tuna melt is off the menu at the Apple Pan, and it is perfection.

The evening activity was Emily’s birthday party. We picked up the NY-style pizzas from Appolonias. There was a serious line, but ours fourteen pizza pick-up had been pre-ordered.

Sunday is my favorite. We picked up my brother and went to Petit Grain Boulangerie for breakfast treats. This bakery is so good that I am not going out on a limb when I say they make the best croissants and scones ever.

My next stop was the farmers market. The fruits, lettuce, vegetables, and everything else made me smile. It was also such a community event—so many families seeing each other. It is so nice. We do the Mar Vista Farmers Market on Sundays, although the Santa Monica one on Wednesdays is the best of them all.

It is fantastic to be in LA and work remotely in NY. One more week, which is the perfect amount.

The post LA Living appeared first on Gotham Gal.

[ad_2]

Source link

Venture Capitalist Firms

Dear SaaStr: I Have No Co-Founder. What Should I Do?

[ad_1]

Dear SaaStr: I Have No Co-Founder. What Should I Do?

That’s okay—plenty of successful startups have been built by solo founders. I’m investing in fact at SaaStr Fund in a solo founder right now. But I’ll be honest: it’s harder.

Most of us need someone to share the burden, especially in the early days when you’re doing everything yourself. Without a co-founder, you’ll need to be strategic about how you build your team and find ways to replicate the benefits a co-founder would bring.

Here’s how I’d approach it:

1. Hire an “Ex Post-Facto Co-Founder”:

This is someone who isn’t technically a co-founder but acts like one. It could be a VP of Product, Sales, or Engineering—someone who takes ownership of a big chunk of the business and cares almost as much as you do. They’ll help carry the load and make key decisions alongside you. Many solo founders find this person later, and it works just as well [7][10].

2. Prioritize Great Early Hires. And Save A Lot of Equity For Them.

This is what Eric Yuan did at Zoom as a solo founder. He brought 20+ engineers with him, with outsized equity packages.

Without a co-founder, your first 10 hires are even more critical. You need people who can operate independently, take ownership, and fill in your gaps. If you’re technical, hire someone who can sell. If you’re business-focused, hire a strong technical lead. These hires will define your company’s DNA and help you scale faster [5][6].

3. Build a Support Network:

You don’t have a co-founder to lean on, so you’ll need to find other ways to get support. This could be a mentor, an advisor, or even a peer group of other founders. These people can help you think through tough decisions and keep you grounded when things get hard [6].

4. Be Brutally Honest About Your Limits:

Without a co-founder, you’ll have to do more with less. That means being clear about what you’re good at and where you need help. Don’t try to do everything yourself—it’s a fast track to burnout. Delegate early and often [9].

5. Don’t Rush Into a Co-Founder Relationship:

If you’re considering bringing on a co-founder now, take your time. A bad co-founder is worse than no co-founder. Look for someone who complements your skills, shares your vision, and is 100% committed. If you can’t find that person, it’s better to go solo and hire great people instead [2][9].

6. Stay in the Deals:

If you’re selling a complicated product, you’ll need to stay deeply involved in sales, even as you hire. Without a co-founder, you’re the face of the company, and customers will want to hear from you. This is especially true in SaaS, where trust is everything [4].

Being a solo founder is tough, but it’s doable. You’ll just need to be more deliberate about building a team that can help you scale and finding ways to stay sane along the way.

[ad_2]

Source link

Venture Capitalist Firms

Top SaaStr Posts & Pods of the Week: Codeium’s VP Sales; Monday’s CEO on AI; Founder Collective on How to Sell Your Startup

[ad_1]

Top Posts:

#1. The Per-Seat Model Isn’t Dead. But Also, Surprisingly, It Was Never Dominant.

#2. Salesforce: We Are Hiring 0 Engineers This Year. But We’re Growing The Sales Team +20%. Because AI.

#3. Egnyte Sells to Private Equity for $1.5 Billion after 18 Years. Slightly Slower and Steady Wins, Too.

#4. Your Team Should Be AI Obsessed Right Now. If They Aren’t, It’s a Flag

#5. AI SaaS Leader Moveworks Sells for $2.85 Billion. But Do Most of Their Investors Make Any Money?

Top Vids + Pods:

#1. How Codeium Built A Billion-Dollar AI Company and a Winning Sales Machine

#2. Why I’m Scared to Buy New SaaS Apps Now with SaaStr CEO and Founder Jason Lemkin

#3. AI at Scale: 8 Learnings from monday.com Co-Founder and Co-Ceo Eran Zinman

#4. A 10 Point Checklist To Use When You Sell Your Company: Live at SaaStr Workshop Wednesday:

#5. The Playbook for Going Upmarket with Stripe’s CBO and Checkr’s COO

And see everyone IRL at 2025 SaaStr Annual, May 13-15 in SF Bay!!

[ad_2]

Source link

-

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoA Failing Grade

-

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoSome Email Stats

-

Investors5 years ago

Investors5 years agoShifting corporate responsibility to consumer resilience

-

Investment5 years ago

Investment5 years agoChinese Government Bonds: The Elephant in the Room

-

Investors5 years ago

Investors5 years agoLast Days of The True Tiger Blog!!

-

Venture Capitalist Firms2 years ago

Venture Capitalist Firms2 years agoDear SaaStr: What Percentage of Software Sales Reps Have Earned Over $1m a Year?

-

Venture Capitalist Firms5 years ago

Investing In Learning

-

News5 years ago

News5 years agoNew Managing Director in Michigan Branch Nina Salvaggio