Trading1

Understanding Crypto Arbitrage Trading Strategies, Risks, and Opportunities

Understanding Crypto Arbitrage Trading

Crypto arbitrage trading offers unique opportunities for traders to capitalize on price discrepancies across various platforms. Many investors are drawn to this approach due to its potential for profitability. Crypto Arbitrage Trading click here to learn more about essential trading strategies. But what exactly is crypto arbitrage trading, how does it work, and what should traders be aware of? In this article, we will delve into the fundamentals of crypto arbitrage trading, exploring its various types, methods, risks, and tips for success.

What is Crypto Arbitrage Trading?

At its core, crypto arbitrage trading involves taking advantage of price differences of the same asset across different exchanges. Traders buy a cryptocurrency at a lower price from one exchange and sell it at a higher price on another, thus profiting from the gap. This phenomenon occurs due to variations in supply and demand, trading volumes, and changes in market sentiment among exchanges. By understanding these market dynamics, traders can create profitable strategies and optimize their trading outcomes.

Types of Crypto Arbitrage

There are several types of arbitrage strategies that traders can employ in the cryptocurrency market. Here are the most common ones:

1. Spatial Arbitrage

This is the most straightforward form of arbitrage trading, where a trader identifies a price difference for the same cryptocurrency on different exchanges. For example, if Bitcoin is priced at $40,000 on Exchange A and $40,500 on Exchange B, a trader could buy Bitcoin from Exchange A and immediately sell it on Exchange B to earn a profit. While this method can be highly effective, it requires quick execution and awareness of transaction fees, which can affect overall profit.

2. Statistical Arbitrage

This approach involves using mathematical models to predict future price movements based on historical data. Traders often employ sophisticated algorithms to identify a correlation between different cryptocurrencies or market conditions. The idea is to capitalize on short-term inefficiencies in the market by identifying when an asset is mispriced compared to its historical norm. Statistical arbitrage can involve trading pairs, such as trading Bitcoin against Ethereum, to take advantage of relative price movements.

3. Triangular Arbitrage

Triangular arbitrage involves three currencies and takes place within the same exchange. Traders exchange one currency for another and then convert it back to the original currency, profiting from any discrepancies in exchange rates. This strategy requires knowledge of forex markets and understanding how to navigate complexities involving multiple currency pairs.

4. Exchange Arbitrage

Exchange arbitrage is related to spatial arbitrage but focuses specifically on taking advantage of pricing differences across different trading platforms. This often necessitates users to have accounts on multiple exchanges, as well as an understanding of withdrawal and deposit times, as delays can diminish potential profits.

Risks of Crypto Arbitrage Trading

While crypto arbitrage presents lucrative opportunities, it is not without risks. Here are some key risks traders should consider:

1. Market Volatility

The cryptocurrency market is known for its extreme volatility. Price discrepancies can close rapidly, making it critical for traders to act quickly. A buyer may find that the price difference they relied on has vanished by the time they execute a trade, resulting in losses.

2. Transaction Fees

Every transaction typically incurs fees, which can significantly eat into profits from arbitrage opportunities. Traders must be diligent in assessing whether the potential profit surpasses the transaction fees associated with buying and selling cryptocurrencies across different exchanges.

3. Exchange Limitations

Different exchanges have varying withdrawal limits and processing times, which can hinder a trader’s ability to execute a profitable arbitrage trade before the price discrepancy is resolved. It is essential to be familiar with the terms and limitations of the exchanges being used.

4. Regulatory Risks

Regulatory environments for cryptocurrency trading vary widely across jurisdictions and can change unexpectedly. Traders must stay informed about regulatory developments that could impact their trading activities, particularly for arbitrage operations that span multiple exchanges and countries.

Tips for Successful Crypto Arbitrage Trading

To maximize the potential for profit in crypto arbitrage trading, consider the following tips:

1. Stay Informed

Keeping up with market news, trends, and technical advancements can provide valuable insights into potential arbitrage opportunities. Tools like price alerts can help you identify favorable conditions.

2. Use Automated Trading Bots

Automated trading bots can execute trades quickly based on predefined criteria, which is particularly useful in rapidly moving markets like cryptocurrency. These bots can analyze multiple exchanges simultaneously and execute trades almost instantaneously.

3. Diversify Your Trading Portfolio

Diversifying investments across various cryptocurrencies and exchanges can reduce risk exposure. It’s vital to have various strategies and cryptocurrencies to navigate different market conditions.

4. Monitor Fees Closely

Always factor in trading fees when evaluating potential arbitrage opportunities. Make sure that the price difference clearly outweighs any associated costs.

Conclusion

Crypto arbitrage trading can be an exciting and profitable venture, offering unique opportunities in the bustling world of cryptocurrency. However, it is crucial for traders to remain vigilant about the risks and develop a comprehensive understanding of each trading strategy. By leveraging market inefficiencies and employing the right tools, traders can effectively capitalize on price discrepancies across platforms, turning opportunities into successful trades.

-

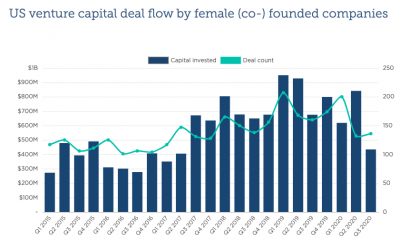

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoA Failing Grade

-

Venture Capitalist Firms4 years ago

Venture Capitalist Firms4 years agoMost Read Blog Posts

-

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoSome Email Stats

-

Investors5 years ago

Investors5 years agoShifting corporate responsibility to consumer resilience

-

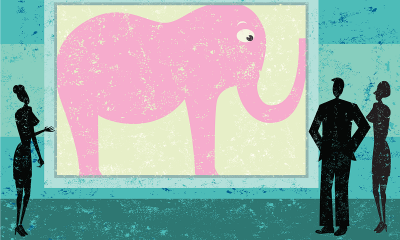

Investment5 years ago

Investment5 years agoChinese Government Bonds: The Elephant in the Room

-

Investors5 years ago

Investors5 years agoLast Days of The True Tiger Blog!!

-

Venture Capitalist Firms2 years ago

Venture Capitalist Firms2 years agoDear SaaStr: What Percentage of Software Sales Reps Have Earned Over $1m a Year?

-

Venture Capitalist Firms5 years ago

Investing In Learning