Angel Investors

Dragon Slayer: how to get funded faster with less time-wasting and pain

[ad_1]

A recent Angel Investment Network webinar heard from investment experts Dan Kirby from Founders Are Mental and Tom Moore from Tucker Capital on how to get funded faster with less time-wasting and pain. One of the key take outs was that investors aren’t just looking for a promising product or service – they’re looking for … Continue reading “Dragon Slayer: how to get funded faster with less time-wasting and pain”

The post Dragon Slayer: how to get funded faster with less time-wasting and pain appeared first on Angel Investment Network Blog.

[ad_2]

Source link

Angel Investors

The Motivations of Angel Investors: Insights and Advice for Startups

[ad_1]

Understanding what drives angel investors is essential for any startup seeking funding. It’s not just about showcasing your business’s strengths; it’s about stepping into the investor’s shoes. After all, angel investors are more than just financial backers; they bring invaluable expertise, mentorship, and network connections. This article takes a deep dive into the motivations of … Continue reading “The Motivations of Angel Investors: Insights and Advice for Startups”

The post The Motivations of Angel Investors: Insights and Advice for Startups appeared first on Angel Investment Network Blog.

[ad_2]

Source link

Angel Investors

Startup Essentials: Understanding Your Buyer Persona: A Startup’s Secret Weapon in the Digital Age

[ad_1]

AIN recently collaborated with our partner HubSpot for Startups to deliver a webinar focusing on Understanding Your Buyer Persona. As part of our Startup Essentials series, we give you the lowdown. In today’s fiercely competitive business landscape, startups face a constant struggle: cutting through the noise and reaching the right customers. In this world buyer … Continue reading “Startup Essentials: Understanding Your Buyer Persona: A Startup’s Secret Weapon in the Digital Age “

The post Startup Essentials: Understanding Your Buyer Persona: A Startup’s Secret Weapon in the Digital Age appeared first on Angel Investment Network Blog.

[ad_2]

Source link

Angel Investors

Why Your Common Stock Grants Need Vesting Schedules (Even If You’re Solo)

[ad_1]

Vesting schedules aren’t just a formality—they’re a fundamental part of building a strong, aligned founding team. Investors expect them, they help protect your cap table, and they ensure that equity is fairly distributed over time.

The post Why Your Common Stock Grants Need Vesting Schedules (Even If You’re Solo) appeared first on Gust.

[ad_2]

Source link

-

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoA Failing Grade

-

Venture Capitalist Firms5 years ago

Venture Capitalist Firms5 years agoSome Email Stats

-

Venture Capitalist Firms4 years ago

Venture Capitalist Firms4 years agoMost Read Blog Posts

-

Investors5 years ago

Investors5 years agoShifting corporate responsibility to consumer resilience

-

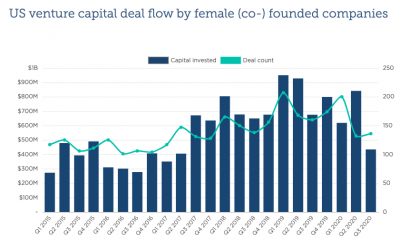

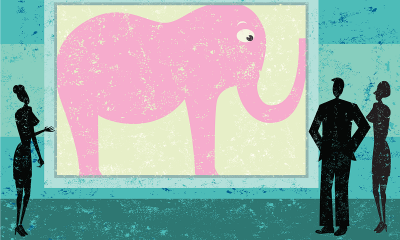

Investment5 years ago

Investment5 years agoChinese Government Bonds: The Elephant in the Room

-

Investors5 years ago

Investors5 years agoLast Days of The True Tiger Blog!!

-

Venture Capitalist Firms2 years ago

Venture Capitalist Firms2 years agoDear SaaStr: What Percentage of Software Sales Reps Have Earned Over $1m a Year?

-

Venture Capitalist Firms5 years ago

Investing In Learning